How good is a business model in the market? Does the service or product have perpetuity? Is there growth potential?

Let’s suppose it is true. Then how efficient should it be to have prosperity?

What I’m saying is the meaning of how value management teamwork based impact on company market-cap?

Economic fundamental analysis for company valuation involves a deep understanding of both macroeconomic and microeconomic factors. There are crucial concepts that we need to show before going forward.

Namely:

- Macroeconomic Analysis: This includes understanding the overall state of the economy, interest rates, inflation, GDP levels, and other broad economic indicators. These factors can significantly impact a company’s performance and future prospects.

- Industry Analysis: This involves evaluating the industry’s competitive dynamics, growth prospects, and key success factors. The industry’s performance can provide context for the company’s individual performance.

- Company Analysis: This includes a thorough assessment of the company’s financial performance, strategic positioning, and future growth prospects. It primarily relies on public data, such as the company’s historical earnings and profit margins, to project future growth.

- Financial Statement Analysis: Fundamental analysis involves digging deep into a company’s financial statements to extract its profit and growth potential, relative riskiness, and to ultimately decide if its shares are over, under, or fairly valued in the market.

- Valuation: Use appropriate valuation methods such as Discounted Cash Flow (DCF), Comparable Company Analysis, or Book Value among others. Each method has its strengths and is chosen based on company specifics, industry trends, and valuation goals.

- Sensitivity Analysis: Test the robustness of your valuation by changing key assumptions and observing the impact on the company’s valuation.

The ultimate goal of fundamental analysis is to quantify a security’s intrinsic value. This intrinsic value can then be compared to its current market price to help with investment decisions. If the fair market value is higher than the market price, the stock is deemed undervalued, and a buy recommendation is given. Conversely, if the fair market value is lower than the market price, the stock is deemed overvalued, and the recommendation might be not to buy or to sell if the stock is held.

Fundamental analysis involves the use of various indicators to assess the economic health and value of a company. Here are some indicators (KPIs) that are typically considered:

| Name | KPI | Description |

| Earnings per Share | EPS | This is calculated as the net income divided by the number of outstanding shares. |

| Price to Earnings Ratio | P/E | This is calculated as the market price per share divided by earnings per share. |

| Projected Earnings Growth | PEG | This is a valuation metric that considers the company’s expected earnings growth rate. |

| Free Cash Flow | FCF | This is the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. |

| Price to Book Ratio | P/B | This is calculated as the market price per share divided by the book value per share. |

| Return on Equity | ROE | This is calculated as the net income divided by shareholder’s equity. |

| Dividend Payout Ratio | DPR | This is the ratio of the total amount of dividends paid out to shareholders relative to the net income of the company. |

| Price to Sales Ratio | P/S | This is calculated as the company’s market capitalization divided by its total sales over a designated period. |

| Debt-to-Equity Ratio | D/E | This is calculated as the company’s total debt divided by its total equity. |

These indicators provide insights into a company’s financial health, operational efficiency, and future growth prospects, which are crucial for fundamental analysis and company valuation.

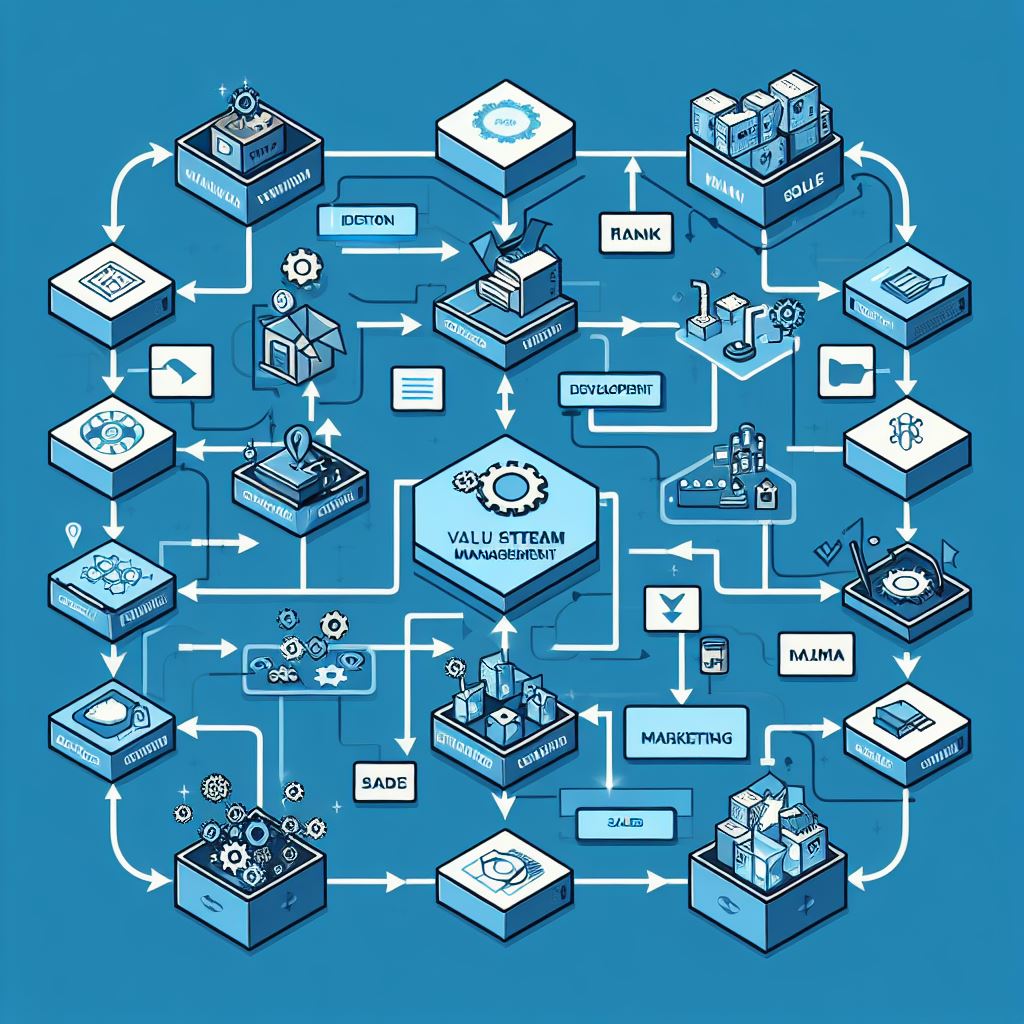

On the other hand, we have a company labor capacity. And Value Stream Management (VSM) as a lean business practice that aims to improve the flow of value to the customer. It involves mapping out all processes in a value stream, identifying areas of waste or inefficiency, and designing a future state that eliminates these inefficiencies.

Herein is how economic indicators can be linked to company value streams and establish a powerful company structure:

Earnings per Share (EPS) and Price to Earnings Ratio (P/E) How to: These indicators can be used to measure the financial impact of improvements made in the value stream. Projected Earnings Growth (PEG) How to: This can be used to estimate the future financial benefits of implementing the future state value stream. Free Cash Flow (FCF) How to: Improvements in the value stream can lead to increased FCF, which is a key indicator of a company’s financial health. Price to Book Ratio (P/B) and Return on Equity (ROE) How to: These indicators can be used to measure the impact of value stream improvements on the company’s market value. Dividend Payout Ratio (DPR) How to: A more efficient value stream can lead to higher profits, which could potentially lead to higher dividends. Price to Sales Ratio (P/S) How to: This can be used to measure the impact of value stream improvements on the company’s revenue. Debt-to-Equity Ratio (D/E) How to: A more efficient value stream can lead to lower costs and potentially lower debt levels.

By linking these economic indicators to VSM, you can quantify the financial benefits of improving your value streams. This can help to justify the resources needed to implement the future state value stream, and it can also help to increase stakeholder buy-in.

A modern company model should have these links between labor capacity focus on the value and company valuation to imply an increase in its share price.

The company operation performance and feature development capacity, both improved by value stream management, have a narrow correlation with company economic health indicators. It should be linked by a covariance matrix to support the management of the company’s valuation.

No responses yet